No credit check catalogues are a convenient option for those looking to make purchases without undergoing a traditional credit check process. These catalogues allow individuals with less-than-perfect credit scores to buy products and make payments in installments. By eliminating the need for a credit check, these catalogues provide an accessible way for people to shop for items they need or want without the fear of being denied based on their credit history. This feature can be particularly beneficial for those who may have struggled to qualify for credit in the past or are looking to build their credit without the risk of being turned down.

One of the key benefits of using a no credit check catalogue is the potential for improved financial flexibility. With the ability to make purchases and pay over time, individuals can spread out the cost of items they need, making budgeting easier and more manageable. Additionally, these catalogues often offer a wide range of products, from clothing and electronics to home goods and furniture, allowing customers to find everything they need in one convenient place. In the following section, we will delve into the key takeaways of using a no credit check catalogue and how it can impact your shopping experience.

key Takeaways

1. No credit check catalogues allow individuals with poor credit histories or no credit to make purchases without undergoing a traditional credit check process.

2. These catalogues can provide access to essential items such as furniture, technology, clothing, and home appliances through installment payments or a “buy now, pay later” scheme.

3. By making timely payments, customers can improve their credit score over time as these catalogues report payment history to credit bureaus.

4. No credit check catalogues often have higher interest rates and fees compared to traditional financing options, so it is essential for consumers to carefully read and understand the terms and conditions before making a purchase.

5. Utilizing a no credit check catalogue can be a convenient and flexible way to afford necessary items for those unable to qualify for traditional financing options, but it is crucial for customers to be mindful of potential financial pitfalls and to manage their finances responsibly.

What are the Benefits of No Credit Check Catalogues?

Convenient Shopping Experience

No credit check catalogues offer a convenient shopping experience for individuals who may have a poor credit history. With these catalogues, you can easily make purchases without worrying about your credit score affecting your ability to buy the items you want.

Build or Improve Your Credit Score

Using a no credit check catalogue responsibly can actually help you build or improve your credit score. By making timely payments on your purchases, you demonstrate responsible financial behavior which can positively impact your credit history.

Access to a Variety of Products

No credit check catalogues typically offer a wide range of products, from clothing and electronics to furniture and appliances. This gives you the opportunity to shop for everything you need in one place, without the limitations of traditional credit checks.

Flexible Payment Options

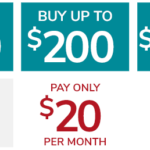

One of the key benefits of using a no credit check catalogue is the flexible payment options available. You can choose to pay for your purchases in full or opt for installment plans, making it easier to manage your budget and payments.

Instant Approval

Unlike traditional credit applications that may take days or weeks to get approved, most no credit check catalogues offer instant approval. This means you can start shopping right away without having to wait for a credit check to be completed.

What are some Tips for Using No Credit Check Catalogues Wisely?

- Make sure to read and understand the terms and conditions of the catalogue before making any purchases.

- Create a budget and stick to it to avoid overspending and potential financial difficulties.

- Make timely payments on your purchases to avoid any late fees or negative impacts on your credit score.

- Monitor your credit utilization and strive to keep it low to maintain a healthy credit profile.

- Regularly review your statements and track your expenditures to ensure you are staying within your financial means.

Frequently Asked Questions

1. What are no credit check catalogues?

No credit check catalogues are catalogs that allow consumers to purchase items on credit without the need for a credit check. This can be a great option for those with poor credit or no credit history.

2. How do no credit check catalogues work?

When you use a no credit check catalogue, you are essentially opening a line of credit with the catalog company. You can then choose items from the catalog to purchase and pay for them over time, often with low monthly payments.

3. Are there any benefits to using a no credit check catalogue?

One of the main benefits of using a no credit check catalogues is that they can help you build or rebuild your credit. By making on-time payments on your purchases, you can improve your credit score over time.

4. What items can I purchase with a no credit check catalogue?

No credit check catalogues typically offer a wide range of products, including clothing, electronics, home goods, and more. Some catalogues may have restrictions on certain items, so be sure to read the terms and conditions carefully.

5. Is there a limit to how much I can spend with a no credit check catalogue?

Each catalogue company will have its own credit limits, which can vary based on your credit history and income. It’s important to stay within your credit limit to avoid any additional fees or penalties.

6. Can I return items purchased with a no credit check catalogue?

Most catalogues offer a return policy that allows you to return items for a refund or exchange within a certain time frame. Be sure to familiarize yourself with the return policy before making a purchase.

7. Are there any fees associated with using a no credit check catalogue?

Some catalogues may charge fees such as annual membership fees or late payment fees. It’s important to review the terms and conditions of the catalogue before opening an account to understand any potential fees.

8. What happens if I miss a payment on my no credit check catalogue?

If you miss a payment on your no credit check catalogue, you may incur late fees and damage your credit score. It’s important to make timely payments to avoid any negative consequences.

9. How can I apply for a no credit check catalogue?

Most catalogues allow you to apply online by providing some basic personal and financial information. Once your application is approved, you can start shopping right away.

10. Are there any alternatives to using a no credit check catalogue?

If you’re looking for alternatives to using a no credit check catalogue, consider options such as secured credit cards, prepaid cards, or buy now, pay later services. These options can also help you build or improve your credit.

Final Thoughts

Overall, no credit check catalogues can be a valuable resource for those looking to make purchases on credit without undergoing a credit check. However, it’s important to understand the terms and conditions of the catalogue, make timely payments, and use the catalogue responsibly to avoid any negative consequences.

Before choosing a no credit check catalogue, be sure to compare options, review fees and terms, and determine whether it aligns with your financial goals. With careful consideration and responsible usage, a no credit check catalogue can be a beneficial tool for managing your finances and improving your credit score.