What is a Buy Now Pay Later Catalogue?

A Buy Now Pay Later catalogue is an online shopping platform that allows you to order items and pay for them later. These catalogues are especially beneficial for people with bad credit or CCJs, as they often extend an instant credit line without requiring a stringent credit check.

How Does Buy Now Pay Later Work?

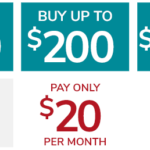

Many people can’t afford to pay for large purchases in full and rely on credit from time to time. Choosing a buy now pay later payment plan gives you the ability to buy what you need now and pay for it later based on specific terms.

- Application Process: Simply add your items to the online basket and start the checkout process. You’ll need to provide personal details and a preferred method of payment for the monthly installments.

- Payment Plans: The total cost of your purchase is divided into equal, monthly catalogue payments over a few months. Some plans may charge interest and fees, while others don’t.

- Credit Terms: The lenient credit terms depend on the lender and your financial position. Some online stores perform a “soft” credit check, which doesn’t impact your credit score.

Requirements for Bad Credit Catalogues

To shop at a buy now pay later online catalog with a bad credit score, you’ll need to meet a few standard requirements:

- At least 18 years of age

- A valid U.S. or UK bank account

- Understanding of the specific terms of the buy now pay later plan

Pros and Cons of Purchasing from Buy Now Pay Later Catalogues

Pros:

- Instant approval for online shopping catalogues

- Flexible payment options

- Opportunity to improve or build credit

Cons:

- Potential interest and fees

- Risk of significant penalty fees for late payments or default

27 Buy Now Pay Later Catalogues for People with Bad Credit

Finding the right catalogues for your needs can be a great way to improve your ongoing credit score or build credit for yourself. Here are some popular options:

- ABT Electronics & Appliances

- Amazon

- Big Lots

- Boscov’s

- Wayfair

- Zebit … and 21 more.

Each of these catalogues offers a buy now pay later payment plan, even if you have a poor credit score. The application process is often simple, and approval can be almost immediate.

FAQs about Buy Now Pay Later Plans

- What apps allow me to buy now and pay later?

- Is buy now pay later a trap?

- Does Amazon do a credit check for buy now pay later?

- What online catalogue sites are similar to Fingerhut?

High 10 Catalogues for Bad Credit 2022

With a poor credit standing, rebuilding your rating is essential, and one way to do that is by regularly obtaining smaller credit and paying back on time. Here are the High 10 Catalogues for Bad Credit in 2022 that can assist you in this journey:

- Fashion World: Offers interest-free periods at affordable prices. Multiple payment options and support for financial issues.

- Jacamo: Specializes in clothing and shoes for larger or taller men. A strong online presence with the latest fashion trends.

- JD Williams: Multiple catalogues offering a wide selection of products. Flexible payment plans for people with poor credit.

- Viva La Diva: Designer shoes and more, with various payment options.

- Brighthouse: Known for electronics and household goods, with tailored credit options.

- Skechers and Vans: Footwear brands with catalogues offering flexible payment terms.

Note: The APR may vary, and some catalogues offer discounts on the first order. Always read the terms carefully to understand the interest rates and payment terms.

Catalogues for Bad Credit & CCJs in the UK

For UK customers struggling with bad credit and CCJs, there are specific catalogues tailored to meet their needs. These catalogues offer a range of products on credit and can help customers improve their credit rating by making regular payments.

- Understanding UK Credit Catalogues: These catalogues undergo credit checks but cater to those with poor credit ratings or a bad credit history.

- Payment Options: Most bad credit catalogues in the UK offer monthly payments and installment plans, allowing customers to manage their finances responsibly.

- Popular UK Catalogues: Some of the larger names include Fashion World, Simply Be, and The Brilliant Gift Shop. They provide a vast selection of products and flexible payment terms.

How to Get a Mortgage with a CCJ on Your Credit Report

Having a CCJ (County Court Judgement) on your credit file doesn’t mean that getting a mortgage is impossible. Here’s how you can navigate this challenge:

Factors to Consider When Applying for a Mortgage With a CCJ

- Value of the CCJ: A small value CCJ from years ago is less problematic than a large recent one.

- CCJ Registration Date: The longer ago it was registered, the less concerning it is to a lender.

- Satisfied vs Unsatisfied CCJs: You are more likely to secure a mortgage if your CCJ has been satisfied (repaid).

- Multiple CCJs: Having more than one CCJ can be tricky but not impossible. A larger deposit may be required.

Tips for Applying for a Mortgage With a CCJ

- Seek Professional Advice: An independent broker can help find a lender with flexible lending policies.

- Prepare Your Application Carefully: Disclose your CCJ and provide context if needed.

- Consider Specialist Providers: Some providers are better suited for applicants with CCJs or other credit issues.

Conclusion

Finding catalogues for CCJs and bad credit doesn’t have to be a daunting task. Whether you’re looking to shop online, rebuild your credit rating, or even secure a mortgage with a CCJ on your credit report, there are options available to suit your needs.

- Buy Now Pay Later Catalogues: These provide instant approval and flexible payment options, making them a popular choice for those with bad credit.

- Top Catalogues for 2022: From Fashion World to Jacamo, there are catalogues designed to help you rebuild your credit rating through regular payments.

- UK Specific Options: For UK customers, there are tailored catalogues that cater to those with poor credit ratings or a bad credit history.

- Mortgages with a CCJ: With professional advice and careful preparation, securing a mortgage with a CCJ is achievable.

Remember, responsible shopping and financial rebuilding take time and effort. Always read the terms carefully and seek professional advice if needed.

Additional Resources

If you’re looking to explore more about catalogues for bad credit and CCJs, here are some additional resources that might be helpful:

- Online Catalogue Sites: Explore sites similar to Fingerhut and others that offer buy now pay later plans.

- Credit Rebuilding Guides: Find guides and tips on how to rebuild your credit score through responsible shopping.

- Mortgage Brokers Specializing in CCJs: Seek professional assistance from brokers who specialize in helping applicants with CCJs.

Tips for Responsible Shopping and Financial Rebuilding

Finally, here are some general tips to guide you in responsible shopping and financial rebuilding:

- Understand Your Options: Know the terms and conditions of any credit or catalogue you’re considering.

- Make Timely Payments: Regular, on-time payments can help improve your credit score.

- Seek Professional Advice if Needed: Don’t hesitate to consult with a financial expert if you have questions or need guidance.

- Avoid Over-Borrowing: Stick to what you can realistically pay back to avoid further financial strain.